When you think of exclusive investment opportunities, forget the Wall Street stereotype. The real action is often happening far from the public markets, tucked away in mission-critical sectors solving tangible, real-world problems.

These ventures are the ones building resilient food supply chains or delivering medically tailored meals. They create a powerful, direct link between profit and social good.

Beyond the Stock Market: Finding Real Impact

The whole idea of "exclusivity" in investing is shifting. It’s no longer just about getting into a high-profile IPO or a hedge fund with a massive buy-in. Today, it’s about private market deals that aren’t tied to the dizzying ups and downs of the S&P 500. They offer a completely different kind of value—one rooted in direct community impact.

Typically, these opportunities are only on the radar of accredited investors, family offices, and institutions with the right networks to unearth them. Unlike publicly traded stocks, these are direct stakes in private companies. They're often overlooked by mainstream analysts but are absolutely essential to how our communities function.

The Rise of Impact-Driven Ventures

Just think about the incredible logistics it takes to get government nutrition programs, like the Child and Adult Care Food Program (CACFP) or WIC, to the people who need them most. Or picture the specialized supply chains that enable healthcare providers to use "Food is Medicine" programs to fight chronic diseases.

These aren't just concepts; they're high-growth sectors where operational excellence translates directly to social benefits and financial returns. When you invest here, you're backing the very infrastructure of community health and resilience.

The principle is refreshingly simple: financial success should be a direct byproduct of mission success. When a company gets better at delivering compliant meals to children, its revenue grows. When a logistics provider ensures medically tailored groceries reach patients, it lands larger healthcare contracts.

This creates a self-reinforcing cycle where positive impact fuels sustainable growth. It's why savvy investors are drawn to these ventures:

- Non-Correlated Returns: Their performance is often independent of public market swings, offering powerful portfolio diversification.

- Tangible Outcomes: You can literally see your capital at work—in meals delivered, health outcomes improved, or supply chains fortified.

- Solving Real Problems: They tackle systemic challenges, creating long-term value that a quarterly earnings report could never capture.

To really get what's happening 'beyond the stock market,' you have to understand the world of alternative investment. Asset classes like private equity and direct investments are where these exclusive deals live. This guide will walk you through how to find, evaluate, and get into these unique opportunities, helping you move beyond a conventional portfolio to build wealth while strengthening communities.

Where to Find High-Impact Investment Arenas

Spotting a truly exclusive investment opportunity means looking past the hype. It’s not about chasing trends; it's about digging into sectors that solve fundamental, non-negotiable human needs.

In food security and logistics, this means finding the sweet spot where market demand is fueled by deep systemic challenges. The real opportunities are at the intersection of public health, government compliance, and smart technology. These are markets where a venture’s most valuable asset is its ability to navigate a maze of regulations and deliver essential services at scale.

Tech-Driven Food Logistics for Complex Needs

One of the most promising areas is specialized, tech-driven food logistics. This isn't your standard warehouse-and-trucking play. We're talking about intricate supply chains built for highly regulated environments where failure is simply not an option.

Imagine the sheer complexity of delivering meals for government-sponsored programs. A provider has to manage everything from USDA-compliant food sourcing to maintaining cold-chain integrity for milk in multi-day meal kits headed to childcare centers. This is where technology becomes the game-changer.

Think about these real-world scenarios:

- WIC Mobile Shopping: Picture a venture that builds an inventory-aware mobile app allowing WIC participants to shop online and get home delivery. This solves a massive access problem, especially in food deserts. The tech has to flawlessly integrate with state EBT systems and manage complex substitutions, creating a huge barrier to entry for competitors.

- Rural Meal Delivery: Fulfilling meal deliveries for programs like the Summer Food Service Program (SFSP) in rural areas requires sophisticated route optimization, automated parent communication, and foolproof proof-of-delivery systems to ensure compliance and prevent fraud.

- Disaster Response Logistics: After a natural disaster, companies that can rapidly deploy truckloads of ready-to-eat and self-heating meals are providing a mission-critical service. Success here hinges on pre-positioned inventory, advanced warehouse management systems, and strong ties with emergency management agencies.

These aren't simple delivery jobs. They're complex logistical puzzles where technology unlocks efficiency, guarantees compliance, and enables a business to scale.

For an investor, the key is to recognize that the "moat" around these businesses isn't just their technology—it's their deep understanding of regulatory frameworks and their proven ability to execute flawlessly within them.

This operational grit is what makes these ventures prime targets for exclusive investment. You can get a better sense of the specific requirements of these government-funded initiatives by exploring our guide on child nutrition programs.

The Investment Case for the Food is Medicine Movement

Another powerful and rapidly growing arena is the "Food is Medicine" movement. This is the evidence-based practice of using medically tailored groceries and meals to prevent, manage, and even treat chronic diseases like diabetes and hypertension.

The investment case is straightforward: better health outcomes lead to lower healthcare costs.

Managed Medicaid plans and entire healthcare systems are actively looking for specialized logistics companies to deliver these programs. They need partners who can do much more than just drop a box of food on a doorstep.

A successful venture in this space has to prove it can deliver on:

- Clinical Adherence: The ability to assemble and deliver grocery boxes that strictly follow a dietitian's prescription, whether it's for congestive heart failure or renal disease.

- Participant Engagement: Providing recipes, educational materials, and support to help people actually use the food to manage their health effectively.

- Outcomes Reporting: Capturing and reporting key health metrics (like A1c levels or blood pressure) back to the healthcare payer to prove the program's ROI.

This creates a direct, measurable link between a company's logistical skill and its impact on public health, setting it up for long-term, scalable contracts with major healthcare players.

Recent surveys of investors show a clear trend toward direct participation in these kinds of specialized, private market deals. Co-investments have emerged as the leading exclusive investment opportunity, with 32% of global investors identifying them as the most attractive option. This preference for taking direct stakes alongside fund managers signals a desire for better alignment and lower fees. For mission-driven sectors like healthcare logistics, this opens up more exclusive co-investment slots in ventures using technology to perfect "Food is Medicine" supply chains. You can explore the full 2025 investor survey insights on AdamsStreetPartners.com.

Identifying these specific, high-growth niches is the first step toward building a truly impactful portfolio.

A Practical Due Diligence Framework for Impact Ventures

When you're evaluating a mission-driven company, the standard financial playbook just won't cut it. For exclusive investment opportunities in a space as complex as food security, your due diligence has to go much deeper. You need to vet for operational grit, regulatory smarts, and—most importantly—genuine impact. A generic checklist will miss the unique risks and rewards baked into these specialized ventures.

The real work happens when you move beyond the balance sheet to understand how the organization actually executes in the real world. Is "impact" just a buzzword in their pitch deck, or is it woven into the fabric of their daily operations? This is where a structured, multi-faceted framework becomes your best friend for making smart decisions.

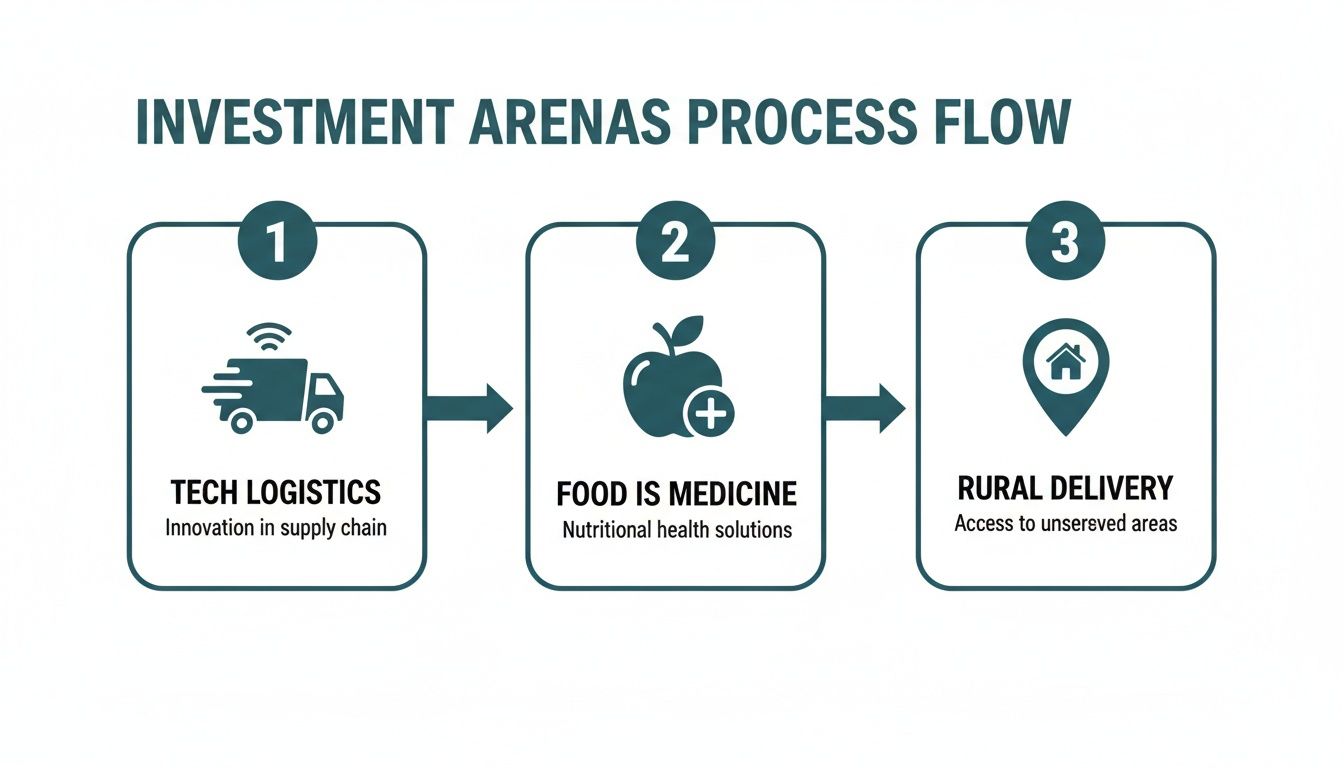

This diagram breaks down the primary investment arenas in our sector. Each one demands its own tailored approach to due diligence.

As you can see, the most successful companies live at the intersection of technology, health-focused nutrition, and that critical last-mile delivery, especially to underserved rural areas.

Assessing Operational Resilience

Operational resilience is the absolute bedrock of any successful logistics or food security company. It’s the proof in the pudding—the tangible evidence that a venture can deliver on its promises, especially when things get tough.

You have to look past the slide decks and get your hands dirty examining the physical and digital infrastructure that makes their mission possible.

Start with their logistics capabilities. Do they run their operations out of an FDA-registered warehouse? This isn't just a bonus point; it's a non-negotiable for food-grade storage, showing a serious commitment to safety. You'll also want to see ironclad cold-chain protocols, particularly if they’re handling perishables like milk for CACFP multi-day meal kits.

Don't be shy about asking for a tour or detailed documentation of their:

- Warehouse Management System (WMS): A top-tier WMS is essential for keeping inventory accurate, tracking lots, and fulfilling orders without a hitch.

- Kitting and Assembly Lines: Ask them to show you how they assemble complex meal kits or medically tailored grocery boxes at scale, with uncompromising quality control.

- Shipping and Carrier Integrations: Who are their partners? Do they have solid relationships with both national and regional carriers to guarantee reliable delivery, even to the most remote corners of the country?

A company's operational muscle is its true competitive moat. It's what allows them to take on the complex government contracts and sensitive healthcare partnerships that others simply can't handle.

Verifying Compliance and Regulatory Expertise

In the world of government programs and healthcare, compliance isn't just a department—it’s the entire game. How well a venture understands and navigates complex program rules is one of the biggest predictors of its long-term survival. This is where your due diligence has to be absolutely meticulous.

First thing's first: verify key certifications. For example, is the company certified by the National Minority Supplier Development Council (NMSDC)? This can be a huge leg up in winning contracts with corporations and government agencies that prioritize supplier diversity.

Next, you need to probe their knowledge of specific program rules. A classic example is the USDA's Buy American provision, which mandates that schools getting federal meal funds must purchase domestically grown and processed foods. A company that has already built its supply chain around this rule is miles ahead of one that hasn't. Incorporating efficient venture capital due diligence practices into your process will help ensure every stone is unturned.

A company that can confidently walk you through its compliance protocols for programs like WIC or SFSP isn’t just showing off its knowledge. It’s demonstrating a core competency that creates a massive barrier to entry for would-be competitors.

This kind of deep regulatory know-how is an invaluable, if intangible, asset that shields your investment from nasty surprises. You can find more of our insights on these frameworks over on our thought leadership page.

Measuring Impact with Metrics That Matter

Finally, an impact venture has to actually prove its impact. Vague mission statements about "doing good" aren't going to fly. Your due diligence must demand clear, quantifiable metrics that draw a straight line from the company's activities to its mission.

Push past simple output metrics (like "number of boxes shipped") and dig for outcome metrics that show real, meaningful change.

A company that’s truly serious about its mission will be tracking these kinds of numbers obsessively. We've put together a checklist to guide your conversations and help you identify the critical proof points.

Impact Investment Due Diligence Checklist

This table outlines key areas to investigate when assessing a mission-driven investment in food security and logistics. Think of it as a starting point for your own rigorous evaluation.

| Diligence Category | Key Questions to Ask | Example Evidence |

|---|---|---|

| Operational Grit | Do you operate from an FDA-registered facility? Can we see your cold-chain logs and WMS reports? | FDA registration certificate, temperature logs for the past 6 months, WMS dashboard screenshot. |

| Regulatory Compliance | How do you ensure compliance with the Buy American provision? What's your process for WIC-approved items? | Written compliance protocols, supplier verification documents, NMSDC certification. |

| Financial Health | What are your unit economics per meal kit? What's your customer acquisition cost for health plan partners? | Detailed P&L statements, cohort analysis, current contracts with payors. |

| Impact Measurement | Can you show us data on health outcomes? How many unique individuals in food deserts have you served? | De-identified patient data showing A1c reduction, zip code delivery reports, participant satisfaction surveys. |

Their ability to provide clear, consistent reports on these fronts is the strongest signal you can get that they are both accountable and effective. This data-driven approach is how you ensure your investment doesn't just generate a financial return, but also creates measurable, positive change where it's needed most.

Structuring Your Investment for Maximum Impact

After you’ve done the hard work of due diligence and pinpointed a venture with real potential, the next step is just as critical: structuring the deal. How you put your capital to work is as important as the company you choose to back. This isn't a one-size-fits-all process; the right structure has to fit your goals, the company's immediate needs, and the shared vision for impact.

Different investors bring different tools to the table. An investment isn't just about writing a check—it can be structured as equity, debt, or some combination of the two. Each path has its own implications for risk, return, and control, shaping how you and the company will grow together. Getting this right from the start is how you ensure your financial goals are perfectly aligned with the company's mission.

Choosing Between Equity and Debt

The first big decision is whether you're providing equity or debt. A direct equity investment means you’re buying a piece of the company. You share in the upside if the business takes off, but you also take on more risk. This is the classic venture capital model, and it's often the best fit for early-stage companies that need fuel for rapid growth.

For example, a private equity firm might take a major equity stake in a logistics company to fund a huge expansion of its physical footprint. They might see a clear path to tripling warehouse capacity or building out a national cold-chain network. Their investment is a bet on the long-term value that this expansion will create, ultimately positioning the company for a lucrative acquisition down the line.

Private credit, or debt, works differently. Instead of taking ownership, you're providing a loan that the company pays back with interest. This structure usually comes with less risk than equity and offers more predictable returns through scheduled interest payments.

Imagine a family office providing debt financing to a food security company that just landed a large, multi-year government contract. The company needs cash upfront to buy inventory and scale up its kitting operations to fulfill the order. A structured loan provides the necessary cash flow without forcing the founders to give up ownership, making it the perfect solution for a specific, project-based need.

Aligning Investment Terms with Mission Goals

Structuring for impact goes far beyond just picking the right financial instrument. The real art is in embedding the company's mission directly into the investment terms. This is how you make sure the relentless drive for financial returns doesn’t accidentally steer the company away from its core purpose. The goal is to create a structure where profit and mission are mutually reinforcing.

Here are a few practical ways you can align terms with impact:

- Impact Covenants: These are specific clauses in the investment agreement that require the company to hit non-financial targets. For a "Food is Medicine" provider, a covenant might mandate maintaining a 95% delivery success rate for medically tailored meals or achieving certain health improvements among its participants.

- Tiered Interest Rates: In a debt deal, you could tie the interest rate to impact metrics. For instance, the rate could drop slightly each year the company successfully meets its goal of serving a target number of people in designated food deserts.

- Board Representation: As an equity investor, taking a seat on the board gives you a direct voice in strategic decisions. This ensures the mission stays at the forefront during critical growth phases.

The ultimate goal is to build a term sheet where financial incentives and impact metrics pull in the same direction. When the company does more good, it should become a better, more valuable investment. This alignment is the hallmark of sophisticated impact investing.

This approach is becoming more important as global investment trends shift. For instance, many investors are now seeking out exclusive opportunities in ex-US equities, particularly in markets like India and Taiwan, as they look to diversify away from China. Healthcare and technology are leading the way, attracting 47% of investor interest, while family offices stabilize their private equity allocations.

For U.S.-focused impact investors, this global perspective translates locally into backing culturally attuned supply chains—think venture capital for compliant meal kits or infrastructure funds for rural cold-chain logistics. You can learn more about the broader trends shaping the 2025 ex-US investment opportunity set on FranklinTempleton.com.

By carefully considering these structures, you shift from being a passive investor to an active partner in the company's success. It’s how you safeguard both your capital and the mission you’re investing in.

The Infrastructure Backbone of Food Security

When looking at investment opportunities in food security, it's natural to focus on the end product—the meal kits, the grocery boxes, the health outcomes. But behind every one of these mission-driven companies is a powerful, often overlooked engine: the physical and digital infrastructure that makes it all happen.

Investing in these ventures is more than a bet on a brand. It's a direct stake in their logistics network. This isn't just some boring, sunk cost. It’s a high-growth asset class where tangible, real-world components generate predictable, long-term demand.

The New Appeal of Real Assets

The market is finally waking up to how critical this specialized infrastructure truly is. We're seeing a massive surge in demand for food-grade warehousing, a severe shortage of cold-chain capacity, and a desperate need for sophisticated warehouse management systems (WMS).

These are the real assets that allow essential services to function, turning what used to be seen as a utility into a high-growth investment.

For investors, this shift presents a compelling opportunity. These aren't abstract financial instruments; they are warehouses, refrigeration units, and software platforms that are absolutely indispensable to community health.

Think of it this way: an investment in a mission-driven food company is also a tactical investment in industrial real estate and supply chain technology. You are backing the very backbone that allows critical food programs to scale effectively and compliantly.

This dual exposure provides a powerful hedge against market volatility. The demand for these services is driven by basic human needs, not quarterly market sentiment. Because of this, the value of the underlying assets often appreciates steadily, providing both stability and growth.

Infrastructure in Action: Real-World Scenarios

The true value of this infrastructure becomes crystal clear when you look at high-stakes situations. In these moments, logistics isn't a footnote—it's the entire story.

- Large-Scale Disaster Response: When a hurricane hits, being able to deploy mixed truckloads of ready-to-eat and self-heating meals within 72 hours is everything. That requires pre-positioned inventory in strategically located, FDA-registered warehouses and a logistics network that can navigate immense disruption.

- Complex Kitting for Meal Boxes: Assembling multi-day meal kits for CACFP or medically tailored grocery boxes for healthcare plans is a masterclass in precision. It demands allergen-segregated storage, advanced inventory tracking to manage expiration dates, and efficient kitting lines to assemble thousands of customized boxes a day.

- Rural Non-Congregate Meal Delivery: Reaching families in remote areas requires more than just a truck. It depends on route optimization software, real-time temperature monitoring for cold-chain items like milk, and robust proof-of-delivery systems to ensure program compliance.

In every case, operational capacity is directly tied to the quality of the underlying infrastructure. Companies that own or control these assets have a huge competitive advantage. For investors looking for exclusive investment opportunities, these are the ventures that can deliver on the most demanding contracts.

You can explore a detailed breakdown of these specialized, infrastructure-driven services to learn more about our logistics solutions.

A Macro Trend Powering Local Impact

This focus on infrastructure also aligns with major global investment trends. As the digital economy expands, the power demand from AI and data centers is creating huge bottlenecks, making private capital in generation, transmission, and storage more critical than ever.

Globally, infrastructure is topping allocation wishlists. A recent report from J.P. Morgan Private Bank highlights that 46% of limited partners plan to increase their investments in the space, driven by the fundamental needs of world trade. You can discover more insights on 2025 alternative investment themes on their site.

For investors in the food security space, this macro trend translates into exclusive stakes in resilient supply chain infrastructure—real assets that can hedge against inflation while generating steady returns. By investing in the warehouses and systems that support food security, you're not just funding a company; you're strengthening the essential framework that nourishes entire communities.

Got Questions? We Have Answers.

Dipping your toe into impact investing can feel like stepping into a new world. The language might sound familiar—you'll hear about returns, risk, and exit strategies—but the mission behind the money adds a whole new dimension. It's only natural to have a few questions when you start looking at opportunities that promise both financial growth and real-world social good.

Let's clear up some of the most common questions that pop up. My goal here is to give you clear, honest answers so you can feel confident investing in mission-driven companies. You’ll quickly see how the right kind of investment creates a powerful cycle where profit and purpose feed each other.

How Do You Balance Financial Returns with Social Impact?

This is the big one, the question I hear most often. The answer is actually simpler than you might think: the best impact models don't have to balance them at all. Instead, financial success is a direct result of executing the mission.

Think about it. A logistics company that's an expert in "Food is Medicine" programs doesn't face a choice between helping patients and making a profit. Every time it gets better at delivering medically tailored meals, it drives better health outcomes for the people it serves. That success, in turn, makes the program more valuable to healthcare payers, who are then eager to renew and even expand their contracts.

The secret is alignment. When you're doing due diligence, you're not looking for a "balance." You're looking for proof that operational excellence drives both profitability and positive change at the same time. The best investment terms will even include specific metrics to lock in this alignment, making sure growth never happens at the expense of the mission.

When a company's financial KPIs and its impact KPIs are marching in the same direction, you know you've found a model built to last.

What Are the Typical Investment Timelines and Exit Strategies?

While the mission might feel different, the nuts and bolts of the investment timeline often look a lot like traditional private equity. Most investors in this space are looking at a 5- to 10-year horizon. That gives a company enough runway to really scale its operations, lock in long-term contracts, and become a leader in its niche.

As for getting your money out, the exit strategies are just as varied. Here are a few paths we see all the time:

- Strategic Acquisition: This is a really common outcome. A larger player in food distribution, healthcare, or logistics might buy a specialized, mission-driven company to instantly get its expertise, contracts, and compliance know-how.

- Sale to a Larger Fund: We also see ventures get sold to mid-market private equity funds that have a knack for taking proven models and scaling them to the next level.

- Long-Hold for Cash Flow: Since many of these businesses are built on long-term government or healthcare contracts, they can become fantastic cash-flow generators. This makes them a great fit for investors like family offices who might choose to hold the investment longer and enjoy the steady, predictable returns.

The bottom line is that investing for impact doesn't mean giving up a clear path to liquidity.

How Do I Know a Company's Impact Claims Are Real?

In this world, trust is good, but verification is everything. Strong impact claims need to be backed by data you can see, count, and check. If all you're hearing are vague statements about "making a difference," that's a big red flag.

Here’s how you can cut through the noise and verify the impact:

- Ask for Specific Metrics: Don't let anyone get away with "we helped people." Demand the hard numbers. How many WIC-compliant grocery orders were delivered to rural zip codes last quarter? What was the exact percentage reduction in A1c levels for participants in the diabetes program?

- Look for a Reporting Rhythm: A company that’s serious about its mission will have regular impact reports that share the good and the bad. That kind of transparency shows they’re accountable and always looking to get better.

- Find Third-Party Proof: The most powerful validation comes from the outside. This could be anything from successful audits by state agencies that oversee nutrition programs, glowing case studies from their healthcare partners, or official certifications from respected groups like the NMSDC.

Real, authentic impact is never afraid to show its work. A company that can hand you this kind of detailed proof isn't just talking the talk—they're walking the walk.

At Umoja Health, we build our programs on a foundation of transparency and measurable results. We provide the data-driven insights and operational excellence our partners need to run compliant, high-impact programs at scale. Discover how our solutions can help you achieve your mission by visiting us at https://umojahealth.com.