To really get investors on board, your story can't just be about your mission. It needs to be about how that mission directly drives your financial success. You have to stop pitching your cause like it’s a charity case. Instead, show them how your purpose is a strategic weapon—one that builds a competitive moat, unlocks lucrative contracts, and fuels real, sustainable growth.

Weaving Your Mission and Margins into One Story

Investors, at their core, are suckers for a good story. But for those of us in the mission-driven food and health space, that story has to hit two notes perfectly: purpose and profit. The pitches that actually land don't treat these as separate ideas. They demonstrate, with hard evidence, how doing good is fundamentally good for business. Your mission isn’t a slide at the end of the deck; it's the very heart of your competitive advantage.

When you frame it this way, the whole conversation shifts from philanthropy to strategic investment. Let’s say your company provides culturally relevant meals to underserved communities. You're not just tackling a social problem. You're forging deep, authentic bonds that bigger, more generic competitors simply can't buy or replicate.

That kind of loyalty shows up on the balance sheet. It means lower customer churn, cheaper acquisition costs, and a brand that government agencies and healthcare partners are genuinely proud to work with.

Frame Your Mission as a Market Differentiator

Don't lead with your passion. Lead with the market gap that only your passion can solve. Your mission grants you access and insights that profit-first companies will never have. That’s your edge, and that's what makes investors sit up and pay attention.

As you build your narrative, think about it from these angles:

- Access to Untapped Markets: Your focus on specific groups—like seniors needing OAA-compliant meals or families in food deserts—opens up entire revenue streams that mainstream providers completely ignore.

- Eligibility for Exclusive Contracts: Many government and healthcare contracts have specific set-asides or strong preferences for mission-aligned and minority-owned businesses. Your company’s structure isn’t just a feel-good detail; it's a key that unlocks multi-year, recurring revenue.

- Built-in Customer Loyalty: When your customers feel seen and believe you're genuinely invested in their health, they don't just buy from you—they become your biggest advocates. That’s an organic marketing engine that no amount of ad spend can compete with.

Quantify Your Social Impact in Financial Terms

This is the crucial step. You have to draw a straight line from your impact metrics to your financial projections. Don't just say you "improve health outcomes." Show how reducing hospital readmissions saves a Medicaid plan a concrete dollar amount, which more than justifies the cost of your program.

The goal is to make your impact tangible and bankable. Every positive social outcome should have a corresponding financial benefit, whether it's increased revenue, reduced operational costs, or a stronger competitive position.

Look at the numbers. Minority-owned businesses alone represent a massive $2 trillion annual revenue opportunity, and smart investors are taking notice. These firms now make up 41% of new commercial accounts, a big jump from 37% in 2021. Highlighting your certification and showing a strong growth curve—like you can see in the story of Umoja Health—can attract capital from funds actively looking to back high-potential ventures that also serve as an economic force. Experian's research offers even more on this powerful trend.

A Real-World Scenario

Let's walk through it. Imagine you’re pitching a program that delivers "Food is Medicine" grocery boxes to people with diabetes. Your story shouldn’t just be about A1C levels. It needs to connect those health wins directly to an investor's bottom line.

Here’s how you could spin that narrative:

- The Problem: Kick things off with the staggering cost of chronic disease management for healthcare providers. Make the pain point real.

- Your Solution: Introduce your 12-week, culturally-aware grocery program that’s proven to improve patient adherence and health markers.

- The Impact-Profit Link: This is the magic. Share data from your pilot showing that participants needed fewer costly medical interventions. Frame it like this: "For every $1 invested in our program, we save the healthcare system $3 in emergency care costs."

- The Investment Ask: Bring it home. Explain how their investment will let you scale this proven model to capture a bigger piece of the multi-billion dollar managed care market.

When you structure your pitch this way, your mission is no longer a charitable side project. It becomes a powerful, data-backed investment thesis. And that’s how you get investors who see the immense value in both your purpose and your potential for profit.

If your pitch deck is the movie trailer, your data room is the full-length documentary. This is where you hand over the audited financials and the behind-the-scenes footage.

It’s the point where an investor's initial interest hardens into real conviction. I’ve seen deals fall apart over a messy data room. It’s one of the fastest ways to signal operational chaos, which is a massive red flag for anyone looking to write a check. For a mission-driven company in food logistics, this is your chance to prove you’ve got a handle on both your impact and your numbers.

Before an investor even clicks open a single file, the structure of your data room is already telling them a story. Is it a digital junk drawer, or is it logically organized with clean, numbered folders? A well-organized room shows you respect their time and, more importantly, have your house in order.

Think of it like a library. Every folder—Financials, Legal, Team, Contracts—is a different section. This simple organization builds immediate confidence before they’ve even seen your margins.

Key Metrics That Actually Matter to Investors

Generic KPIs are useless here. When you operate at the intersection of food, health, and government contracting, your metrics need to speak a very specific language. Investors want to see beyond top-line revenue to understand the unique, often complex, mechanics of your business model.

These are the metrics that will truly move the needle:

- Contract-Level Gross Margins: Don’t just show your overall company margins. Break them down. What’s the margin on your SFSP Rural Non-Congregate kits versus a Medicaid "Food is Medicine" pilot? This proves you know exactly where your money is made.

- Monthly Recurring Revenue (MRR) from Programs: For any program that runs for multiple weeks or months, like a 12-week diabetes grocery initiative, calculating an MRR equivalent shows stability. Predictability is music to an investor's ears.

- Customer Acquisition Cost (CAC) in a B2G World: Let’s be real, landing a government or healthcare contract isn't like selling SaaS. You need to detail the costs tied to that sales cycle—from the grant writing and proposal development to running the pilot. Show you understand this long, unique game.

- Customer Lifetime Value (LTV): How much is a single state agency or managed care organization worth over the life of its contracts? This is how you prove that your B2G sales efforts are worth the investment.

The real purpose of your data room isn’t just to dump documents. It's to preemptively answer every single question an investor could possibly dream up. Your goal is to make their due diligence feel smooth, reassuring, and frankly, easy.

The Must-Have Documentation You Can't Afford to Miss

Financial models are one thing, but the paperwork in your data room is what validates every claim you’ve made. This is where you prove your traction is real, your operations are compliant, and your business is built on a solid foundation. An absolutely critical piece here is clarity on your legal and financial setup; understanding how to go about choosing the right business structure is foundational to presenting a solid, investor-friendly entity.

Organize everything into meticulously clear folders. Here’s a checklist tailored specifically for a food and logistics startup:

Corporate & Legal Documents

- Articles of Incorporation and Bylaws

- Your Cap Table (showing every single equity holder)

- Board meeting minutes and consents

- Any NMSDC or other minority-owned business certifications

Financial & Operational Documents

- Historical financial statements (go back 3 years, if you can)

- Detailed financial projections (looking out 3-5 years)

- A unit economics breakdown for key products (e.g., your true cost-per-kit)

- Warehouse and 3PL agreements (especially key partners like Unidad Logistics)

Contracts & Customer Proof

- Scanned copies of all signed customer contracts (especially government agencies or MCOs)

- State-level program approvals (for programs like SFSP or WIC)

- Letters of intent (LOIs) from big-name potential customers

- Case studies or testimonials from your key partners

Compliance & IP

- FDA registration documents for your facilities

- Food safety plans and any third-party audit results

- Any trademarks, patents, or other intellectual property filings

Getting all this assembled before you even start your outreach is a power move. It tells investors you're professional, prepared, and serious about getting a deal done. This level of readiness isn't just helpful—it's a core part of your strategy to attract the right investors.

Designing a Pitch Deck That Wins Over Capital

Think of your pitch deck as your startup's highlight reel. It’s the visual story that has to grab an investor's attention, build their trust, and convince them to put millions into your vision—all in about ten slides. For a mission-driven company like ours in the food and health world, that document has to be razor-sharp, blending our social impact with rock-solid financial logic.

The narrative arc of your deck is everything. It needs to flow seamlessly from a problem you deeply understand to your unique, scalable solution, and end with a clear investment opportunity. A generic deck is a fast pass to the "no" pile. Yours has to speak the language of population health directors, government program managers, and the complex logistics of food-is-medicine.

The Opening Hook: The Problem and Your Solution

Forget the long backstory. Your first two slides need to hit hard, framing a massive, expensive problem and then positioning your company as the only logical solution.

For instance, instead of just saying "food insecurity is bad," get specific. Your "Problem" slide should shout about the $1.1 trillion annual cost of diet-related diseases. Talk about the logistical nightmare healthcare plans face when they try to roll out effective nutrition programs that can actually scale.

Then, your "Solution" slide comes in with your culturally-aware model. This is where you show how your Rural Non-Congregate kits or 12-week grocery programs aren't just food boxes. They're targeted interventions designed to slash healthcare costs and drive better patient outcomes, all supported by a sophisticated 3PL operation. If you're just starting to piece this together, understanding What is a Pitch Deck? is a great primer for structuring this critical story.

Sizing the Market Accurately

The "Market Size" slide has to be both ambitious and believable. Don't just throw out a number for the entire food industry. You need to break down your Total Addressable Market (TAM) into the real-world segments your model targets.

- SFSP & CACFP: Pinpoint the federal funding allocated to these programs. Show the exact number of eligible children you can reach.

- Managed Medicaid: Zero in on the slice of health plan spending dedicated to supplemental benefits and managing chronic diseases.

- Food Banks: Quantify the volume of food distributed by your key partners and the budgets they have for procured goods.

This level of detail shows you've done the homework. It demonstrates a deep understanding of your niche and gives investors a clear, credible path to how you'll capture that market share.

A great pitch deck answers questions before they are even asked. It shows you understand the investor’s perspective by focusing on risk reduction, market validation, and a clear path to returns, all while staying true to your mission.

The Traction Slide: Your Undeniable Proof

This is often the single most important slide in your entire deck. Traction is the hard evidence that your brilliant idea isn't just a theory—it actually works in the real world. For a business like Umoja Health, traction isn't just about revenue; it's a collection of powerful proof points.

Your traction slide should look like a visual dashboard of your biggest wins:

- Signed Contracts: Showcase the logos of state agencies, major healthcare plans, or large food banks you're already working with.

- Pilot Program Outcomes: Present hard data. Think "Reduced A1c levels by 1.5 points in our diabetes pilot" or "Hit a 98% on-time delivery rate for SFSP kits."

- Procurement Wins: Name the large-scale contracts you’ve secured. This validates your ability to compete and deliver at scale.

Investors are also paying close attention to the incredible growth of minority-owned businesses. Highlighting this can be a huge advantage. These ventures now make up 41% of new commercial accounts, with Black-owned businesses growing an astounding 56.9% from 2017-2022. This momentum, adding over $738 billion to the economy, signals massive scalability and return potential—a compelling point for both impact and traditional investors.

By focusing on these tangible achievements, you shift your pitch from a hopeful ask to a data-backed opportunity. To see more on how we put these ideas into practice, check out our articles on thought leadership at Umoja Health. This is how you get in front of investors who are ready to write a check.

Finding and Engaging the Right Investors

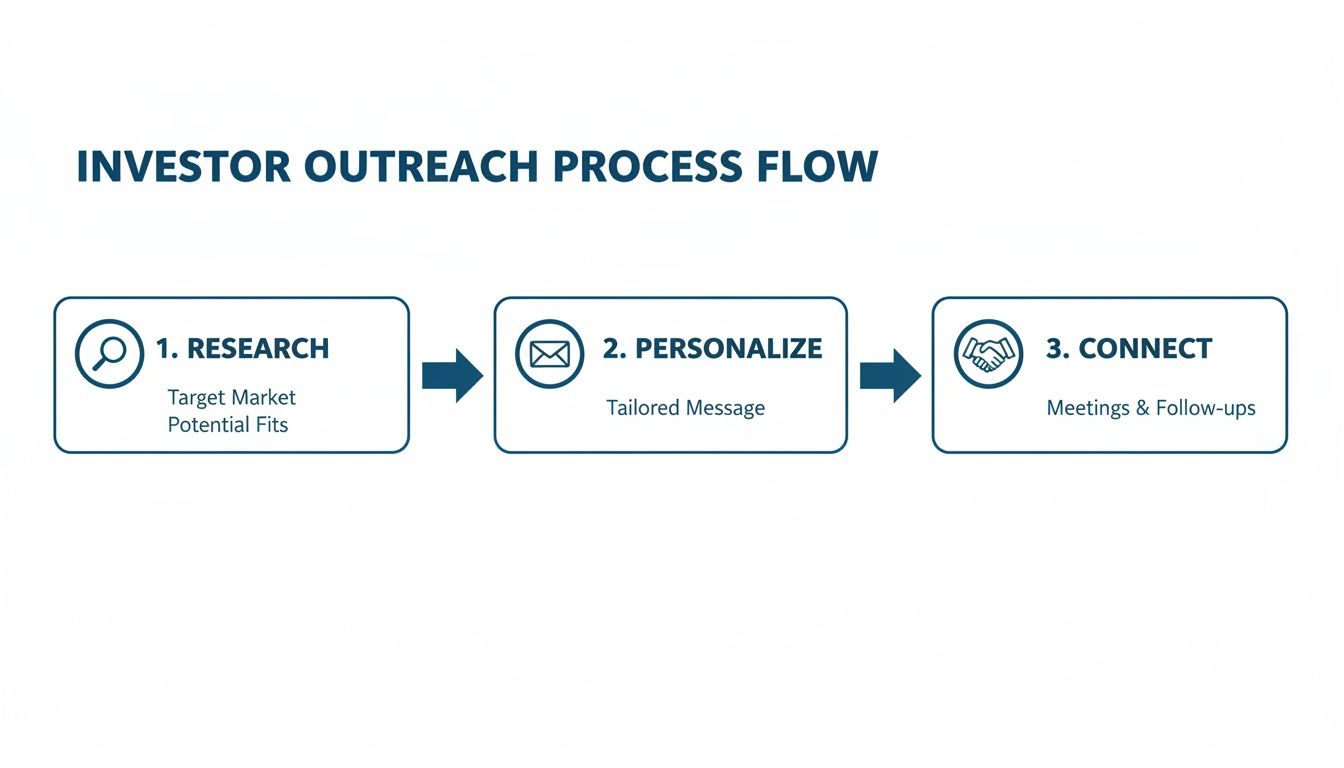

Sending a generic pitch deck to a massive list of venture capitalists is a surefire way to get ignored. If you want to know how to attract investors, it starts with a targeted, almost surgical approach. It's about finding the specific people whose investment thesis and personal passions align perfectly with your mission to tackle health equity through food and logistics.

This isn’t about quantity; it’s about the quality of your connections. Your real job is to turn a cold email into a warm conversation, and that only happens when you’ve done your homework.

Identify Your Ideal Investor Profile

Before you even think about outreach, you need a crystal-clear picture of who you’re looking for. Investors aren't a monolith. They specialize, often obsessively. Start by building a list of funds and individuals who have a proven track record of investing in:

- Food Tech and Logistics: Look for firms that get the grit and complexity of supply chains, not just shiny software.

- Health Equity and Social Impact: These are the investors looking for measurable social returns right alongside the financial ones. They want to see the "why" behind your work.

- Government-Adjacent Businesses (GovTech): Some VCs have a specific focus on companies that sell to or partner with public sector agencies. They understand the sales cycles and unique challenges.

Tools like PitchBook or Crunchbase are fantastic for this kind of research. You can filter by industry, investment stage, and even past deals to see who’s putting their money where their mouth is. The goal here is to create a focused list of 25-50 high-potential investors, not a spray-and-pray list of 500.

Leverage Warm Introductions and Networks

Let me be blunt: a warm introduction is worth a thousand cold emails. It’s the single most effective way to get an investor’s attention because it comes with a layer of built-in trust. Your first step should always be to map your existing network.

Think about leveraging organizations like the National Minority Supplier Development Council (NMSDC). For a certified business, this network isn't just a credential; it's a powerful key for unlocking doors. Highlighting your certification signals that you are part of a booming economic engine that savvy investors and corporate partners are actively seeking out. For instance, Black-owned firms saw revenue growth of 12% to reach $66.5 billion in 2023, while Hispanic-owned firms grew 50% to $114.2 billion. You can dig into more of this compelling data in the NMSDC's 2023 economic impact report.

A warm intro doesn't have to come from a CEO. A thoughtful connection from a trusted advisor, a fellow founder in their portfolio, or even a lawyer can be just as powerful. It's about finding a credible validator who can vouch for you.

Crafting Outreach That Actually Gets a Response

When you have to go in cold, personalization is your only weapon. Generic emails are deleted on sight. Your introductory message has to prove, within the first two sentences, that you’ve done your research and are contacting them specifically for a reason.

Your email should follow a clear, concise flow:

- The Hook: Start by referencing a specific investment they made or something they wrote or said. For example, "I saw your investment in [Portfolio Company X] and was really impressed by your thesis on last-mile logistics for underserved communities."

- The One-Liner: Immediately state what your company does in a single, powerful sentence. "Umoja Health provides culturally-aware, medically-tailored meals to Medicaid patients, solving the engagement problem for health plans."

- The Proof: Hit them with 2-3 of your most impressive traction points. Mention a key contract win, a pilot outcome, or your month-over-month growth. Make it concrete.

- The Ask: Keep it simple and low-friction. Don't ask for a one-hour meeting. Ask for "15 minutes next week to share how our model is uniquely positioned to capture the Food-is-Medicine market."

This approach respects their time and shows you're a serious, prepared founder. It shifts the dynamic from you asking for a favor to you presenting a compelling opportunity—and that’s the key to getting investors to lean in.

To make this even more practical, here’s a template you can adapt. The goal is to make it easy for them to see the fit and say "yes" to a quick chat.

Sample Investor Outreach Email Template

| Section | Content/Goal | Example Snippet |

|---|---|---|

| Subject Line | Make it specific and intriguing. Mention a mutual connection if you have one. | Intro: [Mutual Connection Name] // Umoja Health – Solving [Problem] |

| The Hook | Show you've done your homework. Reference their portfolio, a recent article, or a tweet. | "Hi [Investor Name], I've been following your work since your investment in [Relevant Company] and was particularly struck by your comments on…" |

| The One-Liner | Clearly and concisely state what your company does and for whom. | "My company, Umoja Health, provides medically tailored meals to Medicaid patients, dramatically improving health outcomes and reducing costs for health plans." |

| The Proof (Traction) | Provide 2-3 hard data points that demonstrate momentum and validation. | "We've secured a contract with [Major Health Plan], are seeing 30% MoM growth in meals delivered, and have a waitlist of 500+ patients in [City]." |

| The Why You, Why Now | Briefly connect your mission to their specific investment thesis. | "Given your focus on health equity and logistics, I thought our model for tackling food insecurity in urban areas would be a perfect fit for your portfolio." |

| The Ask | A clear, low-commitment call to action. | "Would you be open to a brief 15-minute call next week to discuss how we're scaling this impact?" |

Remember, the best emails feel personal and get straight to the point. They demonstrate you value the investor's time by proving you've done the work upfront to ensure the conversation will be valuable for both of you.

Navigating Due Diligence and Closing Your Round

Getting a term sheet in hand feels like the finish line, but it’s really just the start of the final lap. This is where an investor's initial excitement gets tested against the cold, hard facts of your business. Welcome to due diligence.

This is the part where they put every contract, financial statement, and operational assumption under a microscope. How you handle this phase says everything about how you run your company. A smooth, organized process builds incredible confidence. A chaotic one can kill a deal that felt like a sure thing just a few weeks prior.

Your goal here is simple: make it easy for them to say yes by proving the story you told is backed by a solid, well-documented reality.

Preparing for the Deep Dive

The single best way to ace due diligence? Prepare for it before you even have a term sheet.

This means building a comprehensive data room now, anticipating every likely request. When the formal checklist lands from the investor’s legal team, you should be able to grant access almost immediately. It’s a powerful signal that you’re organized, transparent, and ready for business.

This isn’t just about speed; it's about controlling the narrative. When your documents are in order, you prevent small questions from ballooning into major delays. A messy capitalization table, for instance, is a classic red flag. Investors need to see a clean, transparent record of who owns what. Any confusion suggests a lack of attention to detail that can spook even the most enthusiastic backer.

This whole process is the payoff for the foundational work you did earlier in your outreach.

The methodical research and personalized outreach you’ve done lead directly to these critical, late-stage conversations where preparation is everything.

What Investors Will Scrutinize

Due diligence typically breaks down into three main pillars. While every firm has its own focus, you can expect them to dig deep into these core areas.

- Financial Diligence: This goes way beyond your P&L. They will verify your revenue by cross-referencing signed contracts, auditing bank statements, and stress-testing your financial model. Be ready to defend every assumption in your projections, from customer LTV to the gross margins on a specific government food program.

- Legal Diligence: Lawyers will pour over your corporate formation documents, board minutes, employee contracts, and any IP filings. They are hunting for potential liabilities—things like unresolved legal disputes or unclear founder equity agreements—that could pose a risk down the road. They'll also vet your key people; a strong, well-documented leadership team, like the one we've built at Umoja Health, is a major asset here.

- Operational Diligence: For a company in food and logistics, this is non-negotiable. Investors will want to map out your supply chain, inspect your 3PL and warehouse agreements, and talk to your key partners. Expect them to conduct customer reference calls to validate every claim you've made about your service quality and relationships.

Think of due diligence not as an interrogation, but as a verification exercise. The investors want the deal to work. Your job is to give them the clear, concise, and accurate information they need to get comfortable and champion your company internally.

Maintaining Momentum to the Close

The time between signing the term sheet and the money hitting your bank can feel agonizingly long—often anywhere from 30 to 90 days. Keeping the momentum going is absolutely critical. Delays create uncertainty and can give investors cold feet.

Assign a single point of contact on your team to manage all due diligence requests. This prevents mixed signals and ensures nothing falls through the cracks. It’s also smart to set up a weekly check-in call with the investment team to review outstanding items and tackle any new questions. This kind of proactive communication shows professionalism and keeps the process moving.

Most importantly, don’t take your foot off the gas. Continue running your business like the funding isn't guaranteed. Hitting a new milestone or signing a key contract during diligence is one of the most powerful signals you can send. It proves your business has momentum independent of their investment, reinforcing that they are backing a winner.

Stay prepared, stay proactive, and you'll navigate this final stage with confidence and close the round that will fuel your mission.

The Investor Questions You’re Sure to Face

When you’re a mission-driven founder, your pitch is going to attract a different kind of scrutiny. Investors aren't just trying to poke holes in your business model; they're digging deep into the connection between your impact and your bottom line. You absolutely have to be ready with sharp, data-backed answers to their toughest questions.

This is where the real work begins, long after the deck is closed. Your ability to handle these conversations with confidence and a deep command of the facts can be the single thing that convinces an investor to get off the sidelines. Let's walk through the three big questions you can pretty much guarantee you'll hear.

How Much Traction Is Enough to Start Pitching?

For a business like ours, traction means a lot more than just revenue. In the early days, investors want to see concrete proof that your model isn’t just a nice idea—it’s a viable business that your target customers are ready to buy into. Financial metrics alone can be deceiving in our world, especially if you're navigating long government sales cycles.

The key is showing real validation from the players that matter. Things like:

- A signed pilot program with a state agency, which proves a government body is willing to bet on you.

- A letter of intent (LOI) from a big healthcare plan, signaling serious commercial interest.

- Hard-hitting case studies with tangible results, like measurable health improvements from a "Food is Medicine" pilot.

Your goal is to prove that the model works and that credible partners will pay for it. Try to lock in at least one or two of these significant wins before you go out for a serious fundraise. It shows investors you’ve already taken a huge chunk of risk off the table for them.

Should I Pitch Impact Investors or Traditional VCs?

The short answer? Both. But you can't walk into both rooms with the same pitch—that's a rookie mistake. Customizing your story is critical. If you don't, it signals a lack of strategic thinking, and that’s a massive red flag for any investor.

When you’re talking to impact investors, it’s all about leading with your "why." They’re already on board with the mission, so give them the data to back it up. They want to see robust impact metrics and a clear, logical theory of change. The global impact investing market is now an estimated $1.6 trillion, so there’s plenty of capital out there from funds that get what you’re doing.

For traditional VCs, you have to flip the script. The mission isn't the story; it's your unfair competitive advantage.

Show them how your laser focus on health equity opens doors to exclusive government contracts. Explain how it builds deep, authentic community trust that bigger, more generic competitors could never replicate. Connect the dots for them and prove, with numbers, how your impact directly fuels your profitability.

Once you prove your mission builds a wider moat and a stickier product, it stops being a "social good" and starts being a brilliant financial opportunity. That’s a story any smart investor will lean in to hear.

What Are the Biggest Mistakes Founders Make in a Pitch?

Having sat through hundreds of pitches, you see the same deal-killing mistakes pop up again and again. The number one offender is not knowing your numbers cold. You have to be able to talk about your unit economics, gross margins, customer lifetime value (LTV), and total addressable market (TAM) without missing a beat. Any hesitation sends a clear signal: you don't have a firm grip on your own business.

Another huge blunder is the generic pitch. Investors see dozens of decks a week, and if yours feels like a template, it's going straight to the trash. Do your homework. Mention a company in their portfolio and explain why you fit their investment thesis. Make them feel like you chose them for a reason.

Finally, nothing kills a deal faster than being unprepared for due diligence. If you get to the final stages and your data room is a mess or you can't back up the claims you made in your pitch, you've instantly destroyed all the trust you've built. It screams operational chaos, and no amount of passion can fix that.

At Umoja Health, we've built our model by answering these tough questions with data-driven proof and operational excellence. If you're a program operator looking for a partner who understands the complexities of mission and margin, learn more at https://umojahealth.com.